Feb. 2013 - Comprehensive taxation agreements with Canada and Italy

CDTAs with Canada and Italy

Nowadays, Canada and Italy are amongst Hong Kong’s major trading partners. Hong Kong boasts one of the largest Canadian communities abroad (estimated to be 295,000 in 2011) whereas there are around 500,000 people of Hong Kong descent in Canada. As of 2011, Hong Kong is Canada’s 10th largest export market. On the other hand, Italy is the 14th largest trading partner and 16th largest re-exports market of Hong Kong.

The CDTAs will further strengthen the economic and trade ties between Hong Kong and these two countries, and provide additional incentives for Canadian and Italian companies to do business or invest in Hong Kong, and vice versa. The CDTAs will also help investors better assess their potential tax liabilities from cross-border economic activities.

Key features

The key features of two CDTAs signed by Hong Kong with Canada and Italy (“Contracting States”) are set forth as follows from the perspective of Hong Kong tax residents:

Person covered

Individuals

Under the two CDTAs, an individual qualify as a Hong Kong resident if:

- He is a permanent resident, i.e. he ordinarily resides in Hong Kong (e.g. he has a permanent home in Hong Kong)

- He is a temporary resident, i.e. he stays in Hong Kong for more than 180 days during a tax year, or for more than 300 days in 2 consecutive tax years, one of which is the relevant tax year.

Corporations

Companies incorporated in Hong Kong and companies incorporated outside Hong Kong but managed or controlled in Hong Kong would be regarded as Hong Kong resident under the two CDTAs.

Salaries income

Income from employment

Hong Kong individual is exempted from tax in the Contracting States if he satisfies the following conditions:

- He is present in the Contracting States for not more than 183 days in any 12-month period commencing or ending in tax year;

- His remuneration is borne by an employer who is not a resident of the Contracting States; and

- His remuneration is not borne by a permanent establishment (or a fixed base in case of Italy) maintained by his employer in the Contracting States.

Directors’ fees

Directors’ fees derived by a Hong Kong resident in the capacity of a member of the board of directors of a company of the Contracting States may be taxed in the Contracting States.

Business income

Active business profits

Under the business profits article, where a Hong Kong enterprise maintains a permanent establishment in the Contracting States, only profits attributable to the permanent establishment will be taxable in the Contracting States.

Associated enterprises (Transfer pricing)

The two CDTAs contained an associated enterprises article which allows Hong Kong or the contracting parties to make transfer pricing adjustments for transactions between associated enterprises. Such adjustments may give rise to potential double taxation. In such case, the article also provides that the tax authorities of the Contracting States are obliged to make an appropriate adjustment in order to relieve the double taxation.

Capital gains

In general, under the two CDTAs, gains on disposal of capital assets by a Hong Kong resident should only be taxed in Hong Kong except if:

- The properties are immovable properties situated in the Contracting States;

- The properties are movable properties of a permanent establishment maintained by the Hong Kong enterprise in the Contracting States;

- The properties are shares of a company (in case of Canada, includes interest in a partnership, trust or other entity forms) of the Contracting States, of which more than 50% of its value (either directly or indirectly) are derived from immovable properties situated in the Contracting States.

Withholding tax on passive income

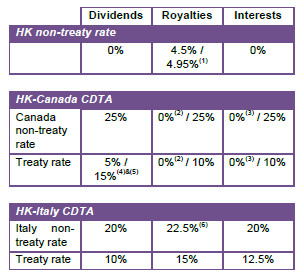

Hong Kong’s CDTAs with Canada and Italy offer favourable withholding tax rates on passive income. The following is a summary of the treaty withholding tax rates for dividends, royalties and interests under the two CDTAs:

(1) 4.5% if received by an unincorporated business; 4.95% if received by a corporation.

(2) A zero royalty withholding tax rate generally applies to:

- A royalty or similar payment on or in respect of a copyright for the production or reproduction of any literary, dramatic, musical or artistic work; and

- A rent, royalty or similar payment related to the use in Canada of computer software or a patent or information related to industrial, commercial or scientific experience or a design, model, plan, secret formula or process.

(3) Generally, the interest that is received by or is credited to an arm’s length non-resident of Canada is exempt from Canadian withholding tax, except for “participating debt interest”.

(4) 5% if received by a company controlling directly or indirectly at least 10% of the voting power in the paying company; 15% in all other cases.

(5) Generally, a “branch tax” of 25% is imposed on the after-tax Canadian source income of a non-Canadian corporation carrying on business in Canada. Paragraph 6 of the dividends article restricts the “branch tax” to 5% under the HK-Canada CDTA.

(6) 30% on 75% of gross receipts of royalties.

Beneficial owner test

It should be noted that for claiming preferential withholding tax rates under the HK-Canada CDTA and HK-Italy CDTA, the recipient has to satisfy the beneficial owner test, i.e. the recipient must be the beneficial owner of the passive income.

Anti-treaty shopping provisions

Furthermore, there are also anti-treaty shopping provisions contained in dividends, interests, royalties and capital gain articles in the two CDTAs which operate to deny the recipient benefits under the treaty if one of the main purposes of the arrangement is to take advantage of the CDTAs.

The two CDTAs will come into force after the completion of ratification procedures in Hong Kong and the Contracting States.