Sep 2023 - Raise specific itemized deductions standards for IIT

Specific itemized deductions standards for IIT

We summarize hereafter the main measures for your information.

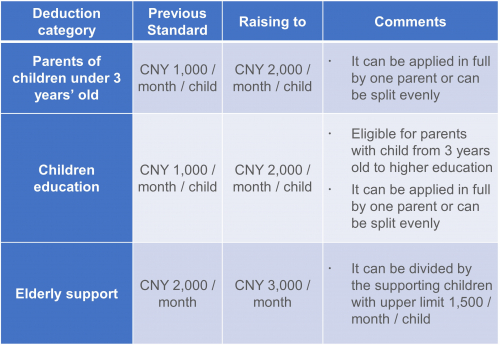

Main specific itemized deductions and new standards

Effective Date

This policy would put in effect since 1 January 2023.

How to enjoy

- Tax system will calculate related IIT with the new standard automatically since September 2023 for the individual who has declared the above specific itemized deductions with the previous standard already, or

- Individual can enjoy this policy during the IIT annual filling of following year.

Point of attention

- The overpaid IIT can automatically offset tax payable in following months of this current year;

- If the deduction cannot be completed, it can continue to be enjoyed during the IIT annual filling of following year.

Should you have questions as to how these measures will impact you, please do not hesitate to reach out to your Mazars contact.

References:

- State Council, [2023] No.13: Notice on Raising the specific itemized deductions standards for Individual Income Tax

- State Administration of Taxation, [2023] No.14: Notice on the continuation of the implementation of the relevant individual income tax preferential policies relating to Equity Incentives(link here in Chinese).