Jun 2022 - Preferential policies for work resumption (in Shanghai)

InsightsOur publicationsAccounting & Outsourcing newsletters

Jun 2022 - Preferentials for work resumption

To support work resumption, the authorities have announced preferential policies. We summarize some of these measures below.

Social contributions payment deferred

Which industries are concerned?

- Catering

- Retail

- Tourism

- Civil aviation

- Road, rail or waterway transportation

- Other industries in dire needs as well as SME and individual businesses severely hit by COVID-19

- Other 17 pandemic-hit industries, including some auto manufacturing and general machinery

Which funds?

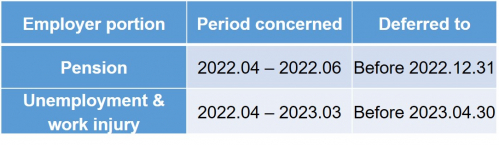

- Pension

- Unemployment

- Injury

Deferred period

Office lease support

- 3 months’ rent waived in 2022 for SME renting from state-owned property.

- 6 months’ rent waived in total during the year for SME renting from state-owned property located in medium or high-risk sub-district/town in 2022, or whose operations were severely affected due to anti-epidemic measures.

- For non-state-owned property, negotiation for rent reduction or exemption is encouraged.

Uncredited VAT refund strengthened

- Uncredited VAT refund will be implemented on a large scale, and priority will be given to micro and small enterprises.

- For SME, period-end uncredited VAT will be refunded in one lump sum by end of June 2022, and a full refund of incremental uncredited VAT will be granted on a monthly basis starting 1 April 2022

Refund unemployment fund

- For SME, raise the refund from 60% to 90% of the unemployment fund paid in 2021.

- For large enterprises, raise the refund from 30% to 50% of the unemployment fund paid in 2021.

One-time subsidies

- For those Shanghai registered enterprises in the seven industries severely hit by the pandemic, including catering, retail, tourism, transportation, culture, sports and entertainment, accommodation, and exhibition, which do not lay off staff or with fewer layoffs, one-time subsidies will be provided by the authorities.

- The subsidy is calculated based on CNY600.00 for each enterprise's social security contributor, with a ceiling of CNY 3 million for each enterprise.

An enterprise shall meet all the following criteria to be considered as SME:

- Enterprises engaging in non-restricted and non-prohibited businesses.

- Annual taxable income amount does not exceed RMB 3M.

- Headcount does not exceed 300.

- Total assets do not exceed RMB 50M.