July 2019 – Mauritius: An Investment Gateway to Africa for Chinese Companies

July 2019 – Mauritius: An Investment Gateway

With its strategic geographic location between China and Africa and its stable regulatory environment, Mauritius looks set to strengthen its position as an investment gateway to Africa under China’s “Belt and Road” initiative.

This article discusses the tax factors that contribute to the success of Mauritius as a preferred investment jurisdiction and highlights some of the structuring possibilities available to Chinese entities looking to invest in Africa. These tax factors include a simple tax system, fast expanding double taxation tax agreements (“DTAs”), and being white-listed by the Organisation for Economic Cooperation and Development (“OECD”).

The Tax System

Mauritius has a simple tax regime. All residents are taxed on their worldwide income on an accrual basis. Non-resident companies are taxed on income that is sourced from Mauritius.

Resident of Mauritius

Under the recent amendments to the Income Tax Act, the residency of a company is determined by the location of its central management and control.1 In a central management and control context, all relevant facts and circumstances must be examined. Such factors shall relate to the business activities of the company, including the use of information and communication technologies in the decision-making process. According to the Mauritius Revenue Authority, generally, a company shall be deemed to have its place of effective management in Mauritius if:

a. The strategic decisions relating to the company’s core income-generating activities are taken in or from Mauritius and

b. Any one of the following conditions is met:

1. The majority of the Board of Directors’ meetings are held in Mauritius; or

2. The executive management of the company is regularly exercised in Mauritius.2

1 Before the amendment, a company was deemed resident of Mauritius if it was incorporated in Mauritius or if central management and control was located there. Section 73A of the Income Tax Act was amended in November 2018 to give effect that where a company incorporated in Mauritius does not meet the central management and control test, it will be treated as non-resident.

2 Statement of Practice (SP 17/18) issued by Mauritius Authority on 28 November 2018.

Taxes on Corporate Income and Mechanism on Companies Holding a Global Business Licence, termed Global Business Companies (“GBCs”)

Companies formed in Mauritius which are resident in Mauritius for tax purposes are generally subject to tax on income at the flat rate of 15 per cent. If the vehicle derives foreign income, including foreign-sourced dividends and interest, the following mechanisms are applicable:

1. Under local tax law, a company may offset any foreign tax paid, both underlying income tax and withholding tax, if any, on the foreign-sourced income against the Mauritius tax on the same income. If the foreign tax paid is greater than the Mauritius tax liability, the Mauritius tax would be reduced to nil.

2. For Mauritius resident companies holding a Global Business Licence ( hereinafter called “Global Business Companies” or “GBCs” ), a partial income exemption of 80 per cent is applicable for specific types of income upon satisfying certain predefined substance requirements. The specific types of income include the following:

- foreign source dividend, provided the dividend has not been allowed as a deduction in the country of source;

- interest;

- profit attributable to a foreign permanent establishment;

- income derived by a collective investment scheme (“CIS”), closed end fund, CIS manager, CIS administrator, investment adviser, or asset manager, licensed or approved by the Mauritius Financial Services Commission (“FSC”); and

- income from ship and aircraft leasing.3

This can be illustrated by the following example:

If a Mauritius resident company has a subsidiary in, say, South Africa, on receiving dividends from the subsidiary in South Africa, the Mauritius company would include the dividends as income of which the Mauritius tax payable is at 15 per cent, but it could claim a foreign tax credit on any tax being paid in South Africa, up to the Mauritius tax payable. If the Mauritius resident company also holds a Global Business Licence (i.e., it is a GBC), only 20 per cent of the dividends received would be subject to Mauritius income tax (i.e., effectively 3 per cent Mauritius income tax is applicable). Consequently, depending on the amount of South Africa tax being paid, the Mauritius resident company can decide which option to take, such that the final Mauritius tax payable is from nil to 3 per cent.

3 Under the old Category 1 Global Business Licence regime (“the old regime”) the mechanism used is deemed a foreign tax credit equal to 80 per cent of the Mauritius tax payable, instead of an 80 per cent partial exemption under the current regime. In the old regime, entities which hold a Category 1 Global Business Licence (GBL1) and which are regulated by the FSC may claim a credit for foreign tax on income not derived from Mauritius against the Mauritius tax payable. To the extent there is no foreign tax being paid or the taxpayer cannot substantiate the foreign tax being paid, the amount of foreign tax paid is deemed to be equal to 80 per cent of the Mauritius tax chargeable with respect to that income. Consequently, the effective tax rate will be between nil and 3 per cent, depending on the circumstances.

Mauritius has committed to reforming its tax system in order to eliminate any aspects that could be deemed as harmful under the OECD Base Erosion and Profit Shifting - Action Plan 5. Under the Finance (Miscellaneous Provisions) Act 2018 (the “Finance Act”), the 80 per cent deemed foreign tax paid mechanism was abolished. The Finance Act harmonises the fiscal regime for domestic and global business companies, removing ring fencing and increasing substance in the jurisdiction, requirements under the OECD. As of 1 January 2019, the GBL1 was abolished and renamed as the Global Business Licence (GBL). The GBL1 will be phased out over a number of years and will be deemed to be a GBL after the phase-out period. The mechanism of taxing a GBL1 holder would be the same as that for a GBL holder.

Capital Gains

There is no capital gains in Mauritius. Where a transaction is in the nature or trade, the tax authority may take the view that it is an ordinary trading transaction and assess the gains derived as income.

Withholding Taxes for Payments to Non-residents

Companies, whether resident or not, are exempt from tax on dividends received from resident companies. There is also no withholding tax for payments made by GBCs to non-residents not carrying out any business.

in Mauritius. A non-resident company receiving service fees or interest from Mauritius is liable to tax thereon at the corporate rate of 15 per cent through a self-assessment system. Interest is either exempt from tax or taxed at reduced rates under certain tax treaties. Royalties payable to non-residents are subject to withholding tax at 15 per cent.

Who Shall Apply for a Global Business Licence?

A resident company meeting the following criteria will be required to apply for a Global Business Licence:

- The majority of shares or voting rights, or the legal/ beneficial interest in the resident company are held or controlled by a person who is not a citizen of Mauritius.

- The company proposes to conduct business or conducts business principally outside Mauritius.

What are the Substance Requirements for a Holder of a Global Business Licence?

A Circular Letter issued by the Financial Service Commission (“FSC”) provides clarifications on the new

enhanced substance requirements.4 A holder of a Global Business Licence shall, at all times:

- Carry out its core income-generating activities in or from Mauritius by a. employing, either directly or indirectly, a reasonable number of suitably qualified persons to carry out the core activities; and b. having a minimum level of expenditure, which is proportionate to its level of activities.

- Be managed and controlled from Mauritius.

- Be administered by its management or by a management company.

In determining whether a holder of a Global Business Licence is managed and controlled from Mauritius, the FSC shall have regard to whether the company:

- has at least two resident directors of sufficient calibre to exercise independence of mind and judgement;

- maintains, at all times, its principal bank accounts in Mauritius;

- keeps and maintains, at all times, its accounting records at its registered office in Mauritius;

- prepares its statutory financial statements and causes such financial statements to be audited in Mauritius; and

- provides for meetings of directors to include at least two directors from Mauritius.5

4 Source: Mauritius Revenue Authority. T4. The FSC published Circular Letter CL1-121018 on 12 October 2018 in respect to substance requirements.

5 Please see Circular Letter CL1-121018 issued by the FSC for detailed clarifications on substance requirements.

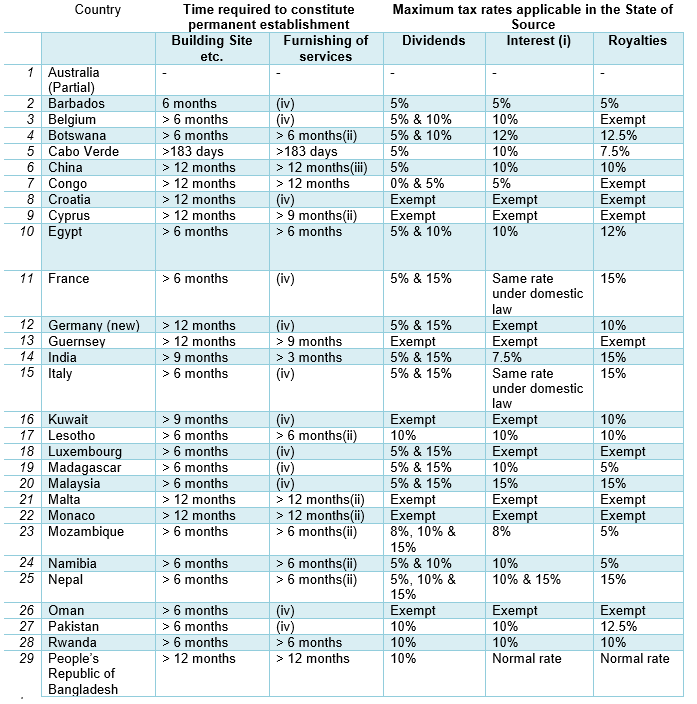

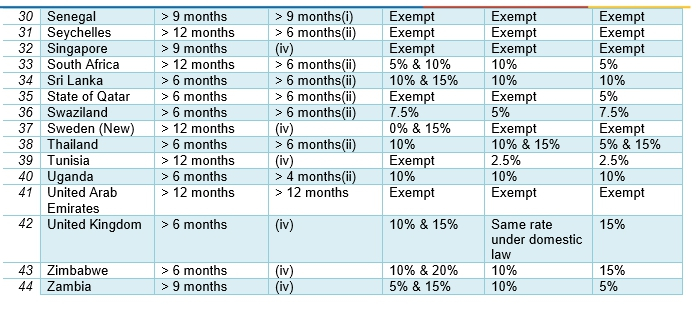

Use of a Mauritius GBC as an Investment Vehicle to Africa

Currently, Mauritius has concluded 44 tax treaties and is party to a series of treaties under negotiation. Of these 44 tax treaties, 14 are with countries in Africa: Botswana, Lesotho, Madagascar, Mozambique, Namibia, Rwanda, Senegal, Seychelles, South Africa, Swaziland, Tunisia, Uganda, Zimbabwe, and Zambia. Three other treaties (Malawi, Nigeria, and Kenya) are awaiting ratification. Additional treaties are currently being negotiated with Egypt, Burkina Faso, Algeria, and Ghana.6 Of these jurisdictions, only a few have tax treaties with favourable holding company jurisdictions such as the Netherlands, Luxemburg, the United Kingdom, and Singapore.

Capital gains tax, where imposed in Africa, is generally levied at a rate in the range of 30 to 35 per cent. However, most Mauritius tax treaties with African countries restrict taxing rights of capital gains to the country of residence of the seller of the assets (i.e., Mauritius). With Mauritius not taxing capital gains, there are significant potential tax savings available by using a Mauritius domiciled entity to structure an investment into Africa.

Almost all African nations impose withholding tax on dividends paid to non-residents, the rate of such imposition ranging generally between 10 to 20 per cent. All Mauritius tax treaties limit the withholding tax on dividends. The treaty rates are generally nil, 5 per cent, or 10 per cent, thereby creating potential tax savings of 5 to 20 per cent depending on the African country in question. If such dividends are received by a GBC in Mauritius, the effective rate of taxation in Mauritius is from nil to 3 per cent, as discussed above. Coupled with the fact that there is no withholding tax on dividends from Mauritius, it makes a Mauritius holding company with a Global Business Licence (i.e., a GBC) a very favourable holding company for Chinese companies investing into many African countries.

Please see Appendix 1 for the highlights of Mauritius tax treaties (Is there a limitation of benefits clause in these treaties?).

6 Source: Mauritius Revenue Authority.

Financing of an African Subsidiary

In addition to using a Mauritius holding company with a Global Business Licence to invest into an African jurisdiction, a Chinese investor can also finance the African ultimate subsidiary partly through a back-toback loan arrangement.

This is illustrated in the following:

- A Chinese company deposits money in a Mauritian bank. Alternatively, the Chinese company can form a Mauritius company which would deposit money in the Mauritian bank.

- The Mauritian bank provides a loan to the African subsidiary.

In most of the Mauritius tax treaties with African countries, there is a provision which exempts interest receivable by a Contracting State itself (i.e., the Mauritius government authority) and its Central Bank/ all banks carrying on bona fide banking business from withholding tax on interest as imposed by the African country. On the paying of interest on the deposit made by the Chinese investor or its Mauritius subsidiary, there is no withholding tax. Consequently, interest after deducting the spread to be earned by the Mauritian bank would be received by the Chinese investor free of withholding tax. In structuring this back-to-back financing arrangement, care must be taken as to the vigorous “know-your-client” procedures undertaken by Mauritian banks.

The Bank of China is already present in Mauritius to facilitate trade between Mauritius and China, and bank accounts can be opened using RMB currency. It is also worth noting that there is free movement of currency in Mauritius.

Conclusion

The African continent has shown a fair degree of resilience, providing, with its under-penetrated markets and unleveraged business opportunities, significant opportunities to China, in particular in China’s Belt and Road initiative. Although Mauritius has yet to officially sign the Belt and Road initiative, it combines the traditional advantages of an offshore finance centre with the distinct advantages of being a treaty-based jurisdiction, with a substantial network of treaties and DTAs, making it the preferred investment platform for investment into Africa. Mauritius offers the following advantages:

- It is a member of SADEC and COMESA, which brings along an extra commercial advantage

- Time zone allowing round the clock global transactions

- Bilingual (English & French) pool of professionals in all fields of business

- Qualified and multi-skilled work force

- Trusted international financial centre

- Political stability

- Chinese nationals do not need visa to come to Mauritius, and they can have an occupational permit to work in Mauritius.

- Well-regulated and transparent jurisdiction

- Banking services: full range of services from international service providers

- OECD white-listed international business platform

- There has been a Chinese embassy in Mauritius for almost 45 years

- There has been a bilateral trade investment treaty with China since 1996/97

Its efforts to reform its tax system to comply with the OECD Base Erosion and Profit Shifting Action Plans make its position of being on the OECD’s white list make it even more preferred as an investment platform.

Appendix 1

Highlights of Mauritius Tax Treaties

Notes:

- Where interest is taxable at the rate provided in the domestic law of the state of source or at a reduced treaty rate, provision is usually made in the treaty to exempt interest receivable by a Contracting State itself, its local authorities, its Central Bank/all banks carrying on bona fide banking business, and any other financial institutions as may be agreed upon by both Contracting States.

- within any 12-month period

- within any 24-month period

- no specific provision made in respect of furnishing of services

Download our latest tax newsletter to explore more details and read Mazars' suggestions.