February 2015 - Fine-Tuning of rules on non-resident indirect transfer by SAT

Fine-Tuning on non-resident indirect transfer

To recap, in 2009, the SAT issued the circular Guoshuihan[2009] No. 698 (“Circular 698”) to address the issue ofindirect equity transfer undertaken by non-residententerprises outside China, i.e., a non-resident enterprise’stransfer of shares in an overseas intermediary enterprisethat directly or indirectly holds an equity interest in a Chinaresident company can give rise to China tax liability, if theChinese tax authority concludes that there is use of abusivearrangement and no commercial purpose in transferringshares of the non-resident intermediary subsidiary insteadof equity interest in China resident company directly.Under that circumstance, the Chinese tax authority can re-characterize the transaction and disregard the existence of the non-resident intermediary enterprise. Bulletin 7 not only abolishes some articles in Circular 698, but also clarifies certain crucial matters related to non-residents’indirect transfer of China taxable assets, including the assessment of “reasonable commercial purpose”, the change of reporting requirement and the introduction of “safe harbor provisions”, etc., which we will highlight in the following sections of this newsletter.

WIDER SCOPE OF APPLICATION

Bulletin 7 has expanded its applicable scope from share transfer in Circular 698 to China taxable assets. This new concept of “China taxable assets” is defined to include equity investment in China tax resident enterprise, immovable properties located in China and assets attributed to an establishment or place of foreign company in China.

Bulletin 7 defines the term “indirect transfer” as non-resident enterprises transfer the equity interest in an intermediary holding company which directly or indirectly holds China taxable assets, including any changes in the shareholders of the non-resident intermediary holding company in the course of the group’s overseas restructuring.In addition, Bulletin 7 also expands the term “equity interest” in the non-resident intermediary holding company to include “similar rights/interests” in that company.

In short, when a non-resident enterprise indirectly transfers China taxable asset through an arrangement without reasonable commercial purpose, but to avoid China Enterprise Income Tax (“EIT’), the transaction can be recharacterized as a direct transfer of Chinese taxable asset by the Chinese tax authority.

APPROACH UNDER BULLETIN 7

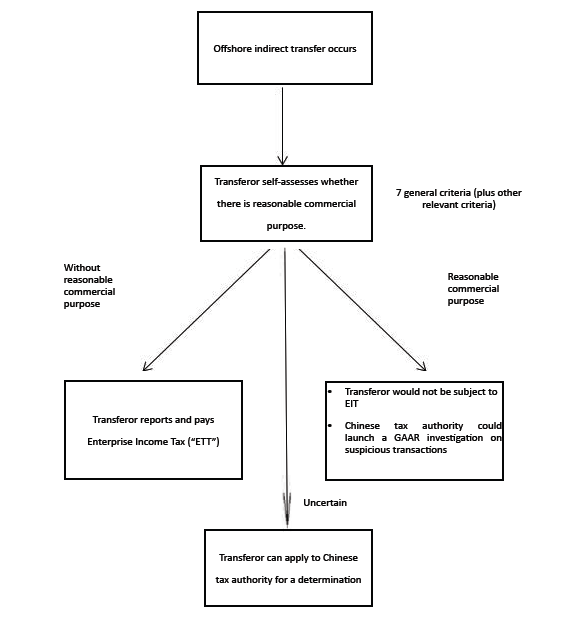

Under the previous approach of Circular 698, the foreign transferor was obliged to report the indirect equity transfer to the Chinese tax authority which would determine whether there were reasonable commercial purposes for the arrangement and make adjustments according to the Chinese General Anti-avoidance Rules (“GAAR”). The deficiencies in the previous approach include the lack of clear criteria to assess reasonable commercial purposes and the lack of tax withholding responsibility on the transferee.

Under Bulletin 7, the mandatory reporting obligation of a foreign transferor in offshore indirect equity transfer has been removed. Instead, a self-assessment by the transferor is required.

This can be illustrated in the following diagram.

ASSESSMENT OF COMMERCIAL PURPOSE

A detailed guidance can be found in Bulletin 7 on how to determine whether an arrangement is having reasonablecommercial purpose. Under Article 3, the following factors should be taken into account in the determination ofcommercial purpose:

i. Whether the equity value of the non-resident intermediary holding company is primarily derived directly or indirectly from China taxable assets;

ii. Whether the assets of the non-resident intermediary company consist primarily of direct or indirect investment in China; or whether the income of the non-resident intermediary company is mainly sourced (directly or indirectly) from China;

iii. Whether the functions performed and risks undertaken by the non-resident intermediary company and its subsidiaries can demonstrate the economic substance of the organizational structure;

iv. The duration of the existence of the non-resident intermediary company’s shareholders, business model and relevant organizational structure;

v. The foreign income tax payment position for the indirect equity transfer;

vi. Whether the indirect investment and indirect transfer can be substituted by direct investment and direct transfer;

vii. The applicability of any tax treaty protection;

viii. Other relevant factors.

These criteria are crucial to substantiate both “reasonable commercial purpose” and “economic substance”.

Assessment of these criteria would be vital for the foreign transferor to decide whether to voluntarily pay EIT or report to the in-charge tax authority for determination and for the transferee to decide whether to withhold EIT.

TRANSACTIONS WITHOUT REASONABLE COMMERCIAL PURPOSE

On the other hand, Bulletin 7 identifies the overall arrangement of indirect transfer as without reasonable commercial purpose if the arrangement simultaneously meets the following situations:

- 75% or more of the value of the non-resident intermediary company is derived (directly or indirectly) from China taxable assets;

- At any time in the preceding year before an indirect transfer, 90% or more of the non-resident intermediary company (excluding cash) is directly or indirectly derived from China taxable assets, or 90% or more of its income is directly or indirectly derived from China;

- The functions performed and risks undertaken by the non-resident intermediary company and its subsidiaries that directly or indirectly hold the China taxable assets are limited and are insufficient to justify their economic substance; and

- The foreign income tax payable for the indirect transfer is less than the potential China tax on the direct transfer of such assets

It should be pointed out that the above unfavorable conditions are based on criteria (i),(ii),(iii) and (vi) of the seven criteria. Consequently, it remains to be seen whether the indirect transfer is “safe” if it does not meet all the above unfavorable conditions. All seven criteria should be analyzed with positive arguments and proper documentation to substantiate that the indirect transfer has reasonable commercial purpose.

SAFE HARBOR PROVISIONS

Bulletin 7 provides ”safe harbor provisions” for an indirect transfer of China taxable assets, under which an indirect transfer will be deemed as an arrangement with a bona fide commercial purpose.

First of all, Article 5 of Bulletin 7 specifies two conditions that will not be regarded as without reasonable commercial purpose and in turn the transaction will not be re-characterized:

- The Non-resident transferor buys and sells the shares of the same listed overseas intermediary company through public stock market; or

- If the non-resident enterprise transferor would otherwise directly hold and transfer the China taxable assets, the income from such direct transfer would be exempted from EIT in China according to the applicable tax treaty or tax arrangement.

Apart from this, group restructuring simultaneously meeting all of the following three conditions can be accepted as having reasonable commercial purpose under Article 6 of Bulletin 7:

I. The shareholding relationship between both transactions parties must meet any one of the following conditions:

- The transferor directly or indirectly hold 80% or more of the shares in the transferee;

- The transferee directly or indirectly hold 80% or more of the shares in the transferor; or

- 80% or more of the shares of both transferor and transferee are directly or indirectly owned by the same shareholders.

The above percentage threshold is increased to 100% for a company which derives more than 50% of its value, directly or indirectly, from immovable properties situated in China.

II. The group restructuring would not lead to the reduction in the income tax liabilities on the gain arising on the subsequent potential indirect transfer; and

III. The consideration of the transaction would only be settled by the share equity of the transferee or its subsidiaries (equities of listed companies are excluded).

REPORTING AND WITHHOLDING OBLIGATIONS

- While Bulletin 7 removes the mandatory reporting requirement to the non-resident transferor under Circular 698, it imposes onerous reporting and tax withholding responsibilities on the transferee, be it a foreign or Chinese party. Failure to report and settle the EIT liability for a taxable transaction would result in interest levy for the foreign transferor and penalty for the transferee.

- Bulletin 7 has clearly imposed a withholding obligation on the payer of the sales consideration (which is usually the transferee). If the payer fails to withhold and the transferor does not settle the tax payable, the in-charge tax bureau can penalize the withholding agent, i.e., the payer, under the Tax Collection Law and Detailed Rules (a penalty of 50% to three times of the tax liability). However, the penalty may be waived if the withholding agent has reported the transaction to the Chinese tax authorities within 30 days after the transfer agreement has been signed.

- Furthermore, Article 13 of Bulletin 7 specifies that if the transferee does not withhold EIT (and the foreign transferor fails to pay the EIT on time), the foreign transferor would be subject to interest on a daily basis calculated based on the Renminbi loan base rate published by the People’s Bank of China plus 5 percent.The additional 5 percent can be waived if the transaction is reported by the transferor within 30 days of signing the transfer agreement.

- Doubtless to say, while the mandatory reporting under Circular 698 is removed, unless the transferor is very comfortable that the transaction would not be subject to EIT under the self-assessment, it is advisable to report to the tax authority for a determination, at least to avoid the 5% additional interest levy. Similarly, the transferee, especially an unrelated party, would be very cautious about the China tax position and the foreign transferor in any indirect transfer.

REMARKS

Bulletin 7 is welcomed by foreign investors because it provides comprehensive guidance on indirect transfers of Chinese taxable assets. As discussed above, it provides more certainty for taxpayers by defining applicable scope,reporting requirement, determination of commercial purpose, withholding obligation of buyers, and penalty for non-compliance, etc. It is highly recommended for multinational companies to review their deals to be entered (or completed transactions without reporting under Circular 698 performed) for the possible impact of Bulletin 7.

Parties in doubt should discuss with their professional tax advisors.